Crypto 40 Tax

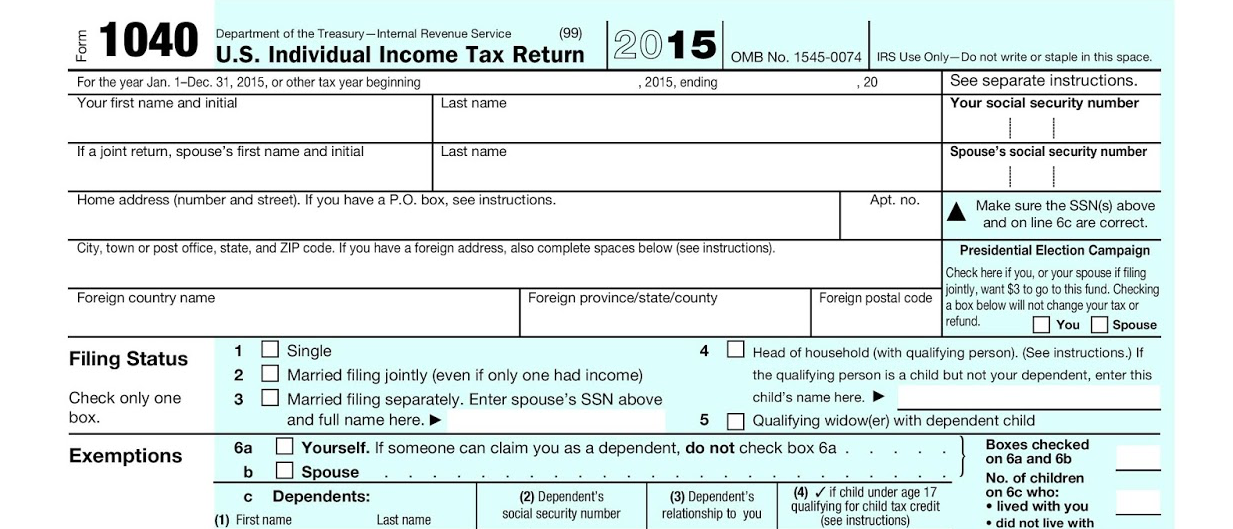

TurboTax TaxACT and HR Block desktop 10000. There are number of complicated difficulties involved for filing and reporting income tax return for income from Crypto currency Bitcoin.

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker

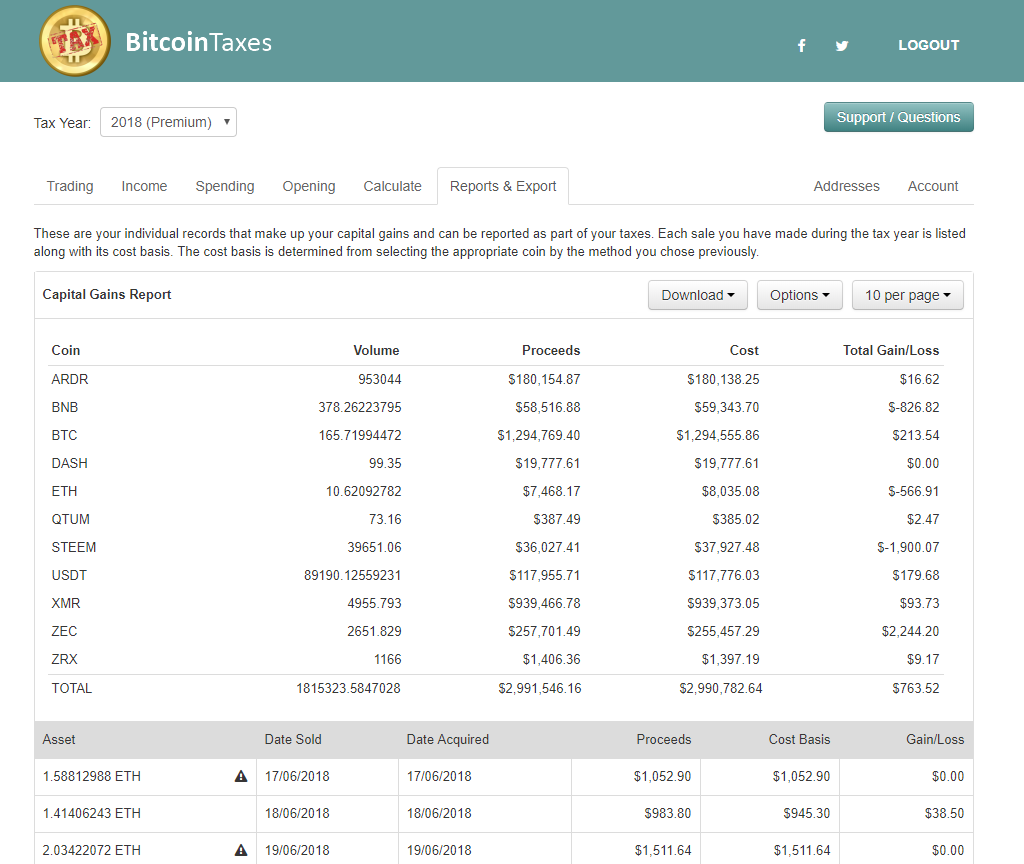

Import API CSV your trades from 110 exchangeswallets.

Crypto 40 tax. Biden is proposing to increase the highest long-term capital gains tax rate from 20 to 396 for those who make over 1 million dollars of income. There are absolutely taxes on the sale of crypto assets that have gained value. This tax hike would negatively impact crypto.

Download Schedule D Form 8949 US only Reports and software imports eg. Youll find more ways to reduce your crypto taxes in our recent crypto tax guide. FIFO and specific identification.

The revenue ruling addresses. Enjoy 40 Off Crypto Tax Calculator Coupons Promo Codes. The functionality of crypto is similar to stocks traded on a brokerage.

Find out 40 crypto tax firms across US states that can help you. Gemini Earn offers 205 on Bitcoin lockings and up to 740 on Gemini Dollar and DAI. Long-term capital gains.

But crypto is different in that it may be more difficult to calculate the cost basis that is so commonly used for tax collection purposes. Learn why 40-50 of millennials are non-compliant in reporting crypto and the cutting edge solution that will help them get back into compliance with the IRS. 4 Strategies For Traders 40 Most of them werent successful but a considerable number of investors were still able to turn crypto into significant profits.

Bitcoin for example is still up roughly 40 on the year despite Fridays tumble. 40 off 6 days ago Get 7 Crypto Tax Calculator coupon codes and promo codes at CouponBirds. Advise your clients about regulated cryptocurrency futures which have more favorable 6040 tax treatment under 1256.

Bitcoin taxes crypto tax audit crypto tax return crypto taxes Aug 18 2021. Cheat sheet for accountants. For Tax payer need to select ITR Form 3 for reporting profit of Trading from Crypto currency.

Its well off its April high around 63000 though Volatility has been a signature of cryptocurrencies. The best crypto tax software. In this video I show you what Tax s.

If your losses exceed your gains in a particular tax year you pay no capital gains tax and can deduct up to 3000 worth of losses from your regular income. Other digital assets interest rates from 448 Filecoin to a lowest of 126 The Graph. Using the IRS discount rates and tables the present value of the remainder interest going to the charity at death would be roughly 101000 satisfying the 10 test.

The Joint Committee on Taxation a Congressional tax authority estimates that boosted crypto tax reporting requirements could raise 28. Did you know that roughly 40 to 50 of the entire. Editorial Team September 22 2021 1200 PM September 27 2021 Comments Off on Cryptocurrency Taxes.

Taxes cryptocurrency bitcoinI dive into crypto taxes with Sean Perry from Node 40 who are 2 software engineers that have created a great platform for t. Binance offers flexible savings and locked savings with. By integrating directly with leading exchanges wallets blockchains and DeFi protocols the CryptoTraderTax engine is able to auto-generate all of your necessary tax reports based on your historical data.

Crypto Taxes Interview With Node 40 Tax Software By Stache on Thursday January 24 2019 I dive into crypto taxes with Sean Perry from Node 40 who are 2 software engineers that have created a great platform for tracking your cryptocurrency taxes across multiple platforms and wallets with their Node 40 Balance crypto tax software. 40 Lac 400 Bitcoin 10000. The tax law was amended in 2020 to include the taxation of crypto assets in the same way as it taxes stocks.

The Crypto Tax Solution For Non-Compliant Millennials. Cryptocurrency tax software like CryptoTraderTax was built to automate the entire crypto tax reporting process. Profit from Bitcoin trading shall be treated as business income of Rs.

The changes introduced a 20 tax for all cryptocurrency transactions above 25 million Korean won. A 40-year-old taxpayer contributes 1000000 of Bitcoin to a trust and assigns a 7 payout rate with themselves as the income beneficiary. Any gains or losses made from a crypto asset held for longer than a year incurs a much lower 0 15 or 20 tax depending on individual or combined marital income.

Trade cryptocurrency in a self-directed IRA. The recently released final text of the reconciliation bill SEC138151 intends to subject cryptocurrency to a complex tax rule called constructive sales. Adjusted cost basis and superficial losses Canada Pooling with same-day and 30-day rules United Kingdom Spot pricing for more than 20000 trading pairs.

Completing a SOC 1 audit provides our customers and partners the. 1 whether a hard fork of a cryptocurrency creates taxable income under 61 if the taxpayer does not receive the new cryptocurrency and 2 whether a hard fork with an airdrop creates taxable income when the taxpayer receives the new cryptocurrency. Click to enjoy the latest deals and coupons of Crypto Tax Calculator and save up to 40 when making purchase at checkout.

Shop cryptotaxcalculatorio and enjoy your savings of September 2021 now. Albany NY October 9 2019 NODE40 the premier cryptocurrency cost-basis tracking company today announced the company has successfully completed the requirements for a Service Organization Control SOC 1 Type I Audit covering its Balance product. As is the case with traditional investments investors can sell crypto at a loss to offset capital gains a strategy known as tax-loss harvesting.

Thats one similarity to fiat-based transactions. Tax season is here and its very important we do our Cryptocurrency taxes correctly to avoid fees and problems later on. The audit was undertaken by Armanino LLP.

Under this proposed rule which could go. Support your DeFi trades eg Uniswap1inch. Roll over unrealized cryptocurrency gains into opportunity zone.

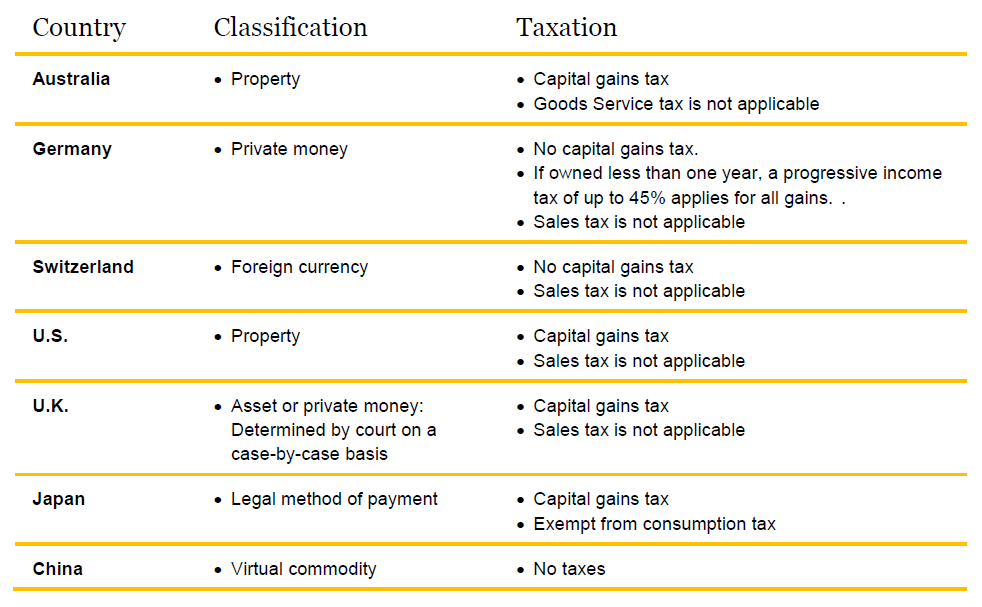

Cryptocurrency Countries In Which Country Cryptocurrency Is Legal Currency Com

What S Your Tax Rate For Crypto Capital Gains

How Are Bitcoin And Other Crytpocurrencies Taxed Jean Galea

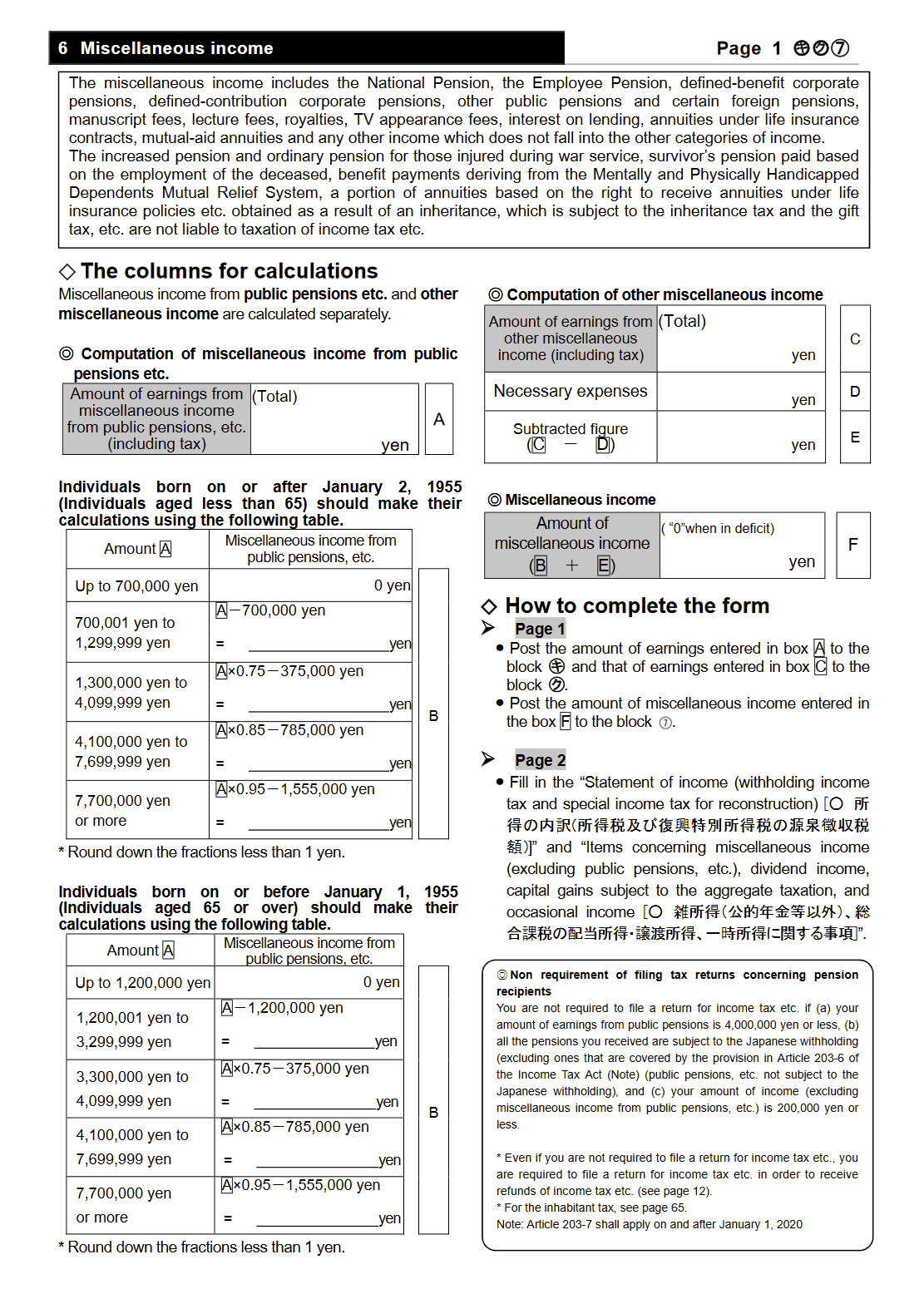

How Cryptocurrency Is Taxed In Japan Tokentax

The Crypto Tax Chapter This Is A Chapter In The Token By David Siegel Medium

Income Tax Implications Of Transactions In Crypto Currency

Biaya Yang Boleh Mengurangi Penghasilan Bruto Menurut Pajak Penghasilan Solusi Pajak

Crypto Tax Australia Cryptocurrency Tax 2021 Guide Fullstack

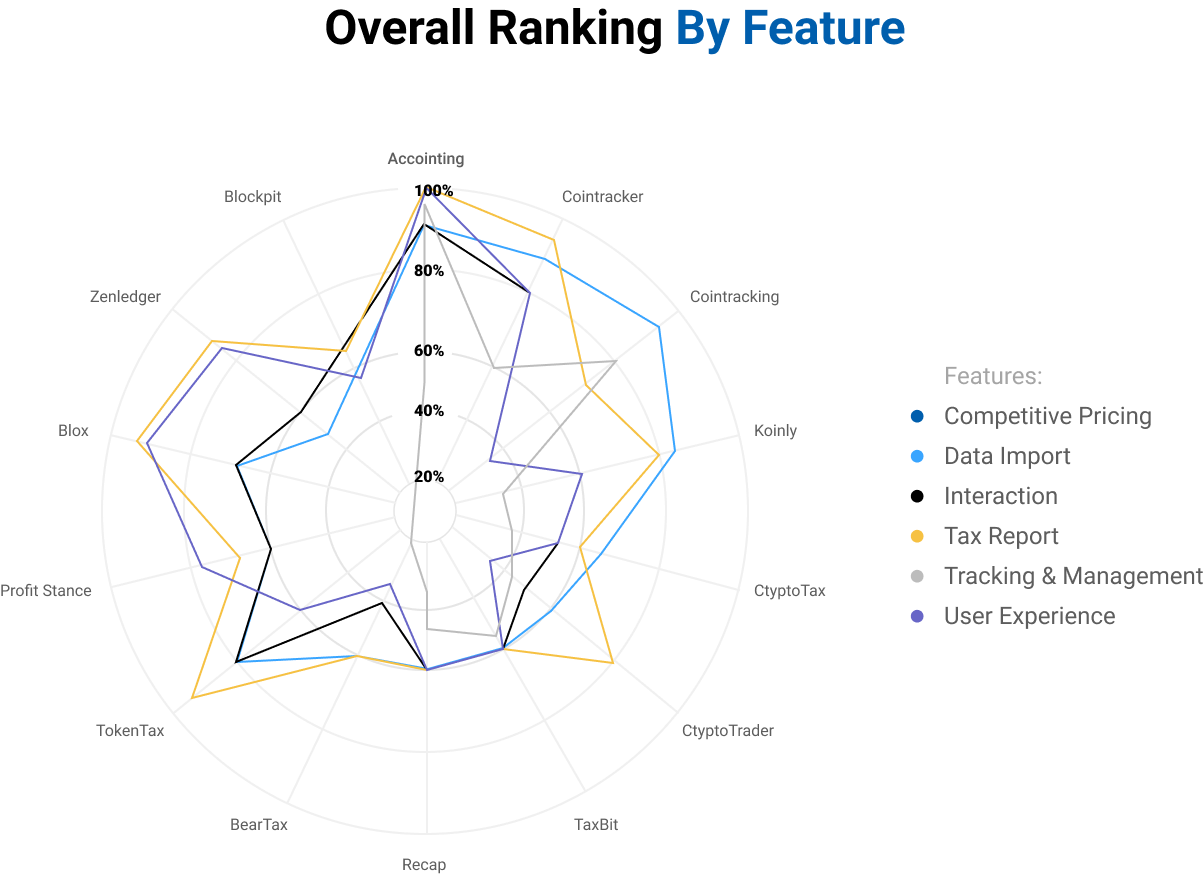

Best Crypto Tax Software In 2021 Coinmonks

Taxation Of Cryptocurrencies In Europe Crypto Research Report

Impact Of Cryptocurrency On Stock Market

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker

Posting Komentar untuk "Crypto 40 Tax"